How Long Do Home Insurance Claims Take?

Most straightforward home insurance claims take a few weeks from the incident occurring to resolution when you submit all the evidence quickly and answer queries. Fire, flood, or complex claims can take several months because investigations, approvals, and necessary repairs add time. If a claim drags, you can complain and escalate after eight weeks.

With rivr home insurance, your claim is handled end-to-end with prompt, expert support; 24/7 emergency help, managed repairs, and no excess on most large claims over £25,000.

What is a home insurance claim?

A home insurance claim is a request to your insurer for costs to repair, replace, or cash settle covered damage to buildings or contents after an insured event. Common examples include escape of water, theft, storm, and fire. Your insurance policy sets out what is covered, the excess deducted from any payment, and any time limits for reporting.

You can usually expect a window of 30 to 180 days to report issues to your insurer after an incident occurs. However, many policies require prompt notification; delaying can prejudice your claim. we recomend reporting a claim as soon as possible (ideally immediately).

Clear documentation underpins every home insurance claim. Insurers assess liability by reviewing photos, videos, receipts, and reports. You should document everything thoroughly by taking photos and videos of the damage before making any temporary repairs. A loss adjuster, who is appointed by the insurer to assess and verify the loss, may visit for larger or more complex claims.

How long different home insurance claims usually take

What drives the timeline? (Factors you can and can’t control)

Severity and complexity are the main drivers. A minor leak in one room may finish quickly, while extensive damage across several rooms needs surveys, quotes, and staged works. Supplier and labour availability can slow insurance providers after widespread storms, and local permitting can add delay for structural reinstatement.

Your part matters. Claims move sooner when you provide all the evidence early, such as photos, videos, receipts, and serial numbers. Clear answers to follow up questions help most insurers assess and approve without extra visits. Obtaining multiple quotes from contractors can provide valuable information during negotiations with insurers. Missing proof, unclear scope, or disputes about liability add steps and can push timelines back by weeks.

An independent professional called a loss assessor can assist on bigger claims or complex claims. A loss assessor acts on your behalf to assemble documents, present scope, and negotiate for a fair settlement where appropriate. Loss assessors are experts in the insurance claims process and help document and assess the full extent of the damage. This support can reduce friction in the claims process and keep decisions on track.

The home claim journey

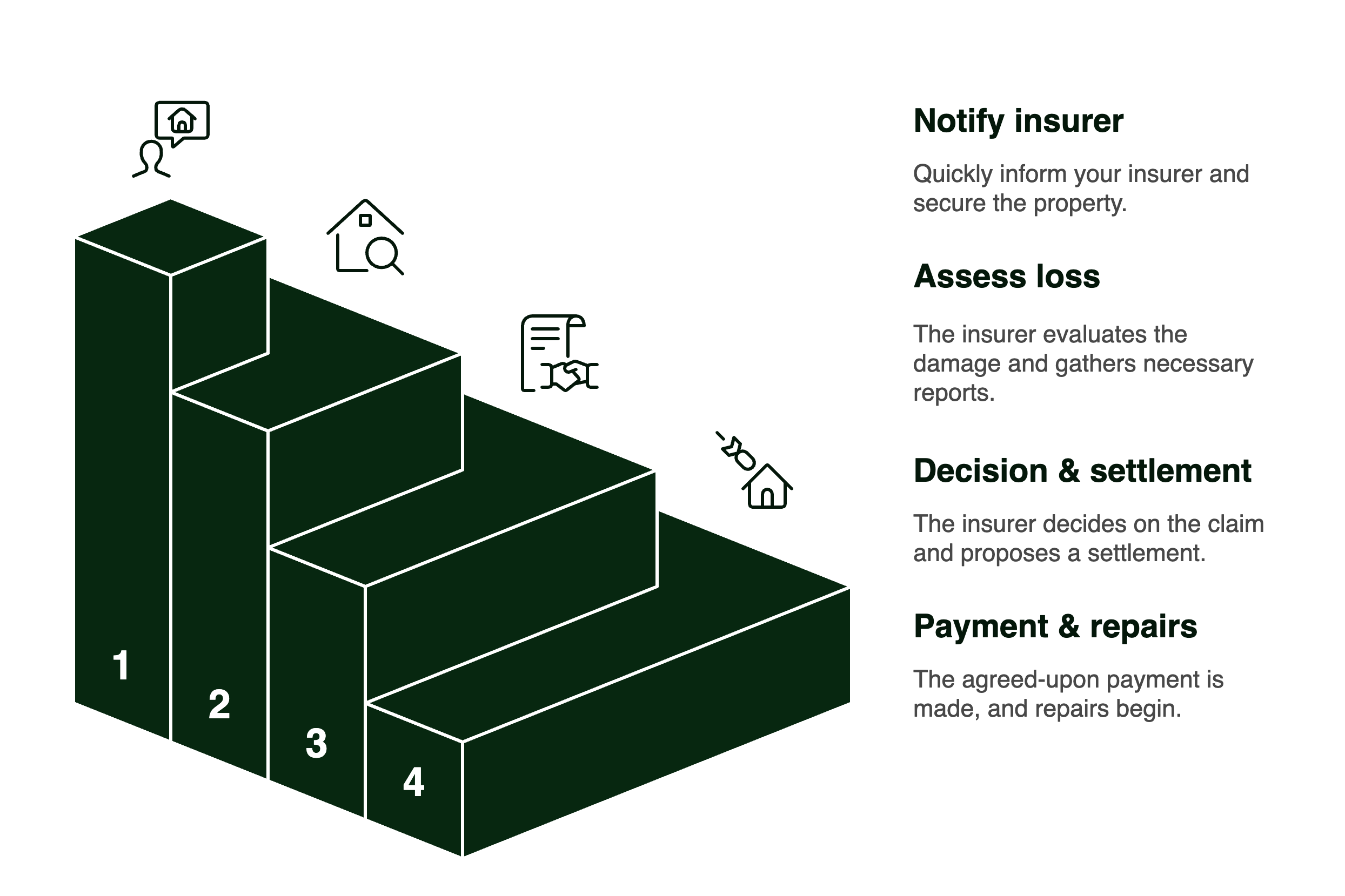

The 4 stages (what happens when)

Most home insurance companies follow four broad stages.

First, you notify your insurer quickly and make the property safe.

Second, the insurer assesses the loss, which may include a loss adjuster visit and requests for quotes or reports.

Third, a decision issues with next steps and a settlement route.

Finally, payment and repairs proceed, sometimes with interim payments where liability is accepted. The ABI outlines these core steps for a home insurance claim and why early contact matters.

Early action helps because evidence is fresher and emergency mitigation prevents further damage. Keep policy documents handy, start a dated photo log, and list damaged items room by room. Responding quickly to requests helps the insurer assess and agree what is covered without repeated visits or queries.

Who does what + typical timing

This is the practical path many homeowners follow when they make a claim. Keep a record of each contact, including dates and names, and save copies of emails and letters. That log becomes vital if the entire process stalls and you later need to escalate.

How long until I’m actually paid?

Payment speed depends on the settlement route and completeness of evidence. A cash settlement can pay sooner once liability is accepted and scope is agreed. Managed repairs route funds to contractors, so you may not receive the full amount directly, though contents items and some costs are paid to you. Once the insurer has everything they need, they will decide the best way to settle your claim. Prompt contact, clear evidence, and cooperation with inspections support faster resolution

For a large claim requiring staged works, insurers sometimes issue interim payments to help with necessary repairs or living costs once liability is confirmed. Keep receipts and invoices because these documents demonstrate spend and help the insurer assess any further payments as the works progress.

Checklist: how to speed up a home insurance claim

Citizens Advice also sets out clear consumer steps for making a claim and what to do if a claim is refused or delayed.

What if my claim is dragging? Escalation & your rights

First step: start with a formal complaint to your home insurance provider. Explain what has gone wrong, the outcome you seek, and include your timeline and copies of correspondence. Under the FCA’s complaints rules, most firms must issue a final response within eight weeks of receiving your complaint.

If they do not respond within that time or you disagree with the outcome, you can escalate to the Financial Ombudsman Service. After the final response, you generally have six months to refer your case, and the ombudsman explains these time limits for consumers on its site.

When you escalate, stay factual and concise. Include reports, receipts, photos, and a clear list of the decisions you dispute. Keep making the property safe and retain invoices, because necessary mitigation remains your responsibility under most home insurance policies.

Will my premium go up after a claim?

Premiums often rise after a claim, but the impact depends on claim type, cost, and your history. You may decide a very small loss is not worth making a home insurance claim once you consider your excess and any likely price change at renewal. Recent home insurance pricing trends and market context that can help set expectations

As a practical example, a minor contents loss that would cost thousands to put right can still justify a claim if it exceeds your excess and is covered. By contrast, a £250 repair on a policy with a £200 excess may be simpler to pay yourself, particularly if you want to avoid another claim on record.

rivr: High-value home insurance, built around modern life

rivr is a high-value, digital-first home insurance provider built around the needs of modern lifestyles. We offer tailored cover with clear limits, and end to end claims support, including 24 hour emergency help, managed repairs, and no excess on most large claims over £25,000.

Speak to our team today to find the right level of contents cover for your home and lifestyle.

Read more

Frequently asked questions

For a simple home insurance claim with clear evidence, expect around three to four weeks. Fire damage can take two to three months. A major flood with extensive damage can take seven to eight months or more where drying and reinstatement run in stages.

Payment arrives after liability is accepted and the settlement route is agreed. Cash settlements can pay faster than managed repairs, and interim payments may be available once works begin on a large claim.

We do our utmost to make claims quick and simple. You should tell us immediately after an incident. We’ll confirm your cover, what we need from you, and get things moving.rivr makes claims quick and straightforward. When something happens, contact rivr right away by phone or email. The claims team confirms what’s covered, explains next steps, and manages everything for you.

They can send approved repairers to make your home safe, arrange repairs or replacements, and keep you updated. You usually don’t need to find your own contractors, and the workmanship is guaranteed.

For emergencies such as a burst pipe or power failure, the 24-hour home emergency helpline is always available.

For larger claims over £25,000, the excess doesn’t apply (except for subsidence or any higher policy excess). If your home can’t be lived in after an insured event, rivr can arrange alternative accommodation for up to 36 months.

In short, rivr manages your claim from start to finish with fast support, trusted repair partners, and 24/7 help when you need it most.

Notify and make safe, assessment and evidence, decision and settlement route, then payment with repairs or replacement. Keep policy documents, photos, receipts, and a contact log to keep the claims process on track.

Processing depends on inspections, reports, approvals, and supplier availability. After major storms, many homeowners wonder why insurance claims take longer. The answer is capacity pressure across surveyors, trades, and insurers, along with permitting for structural work. Strong evidence and fast responses reduce delays.

There is no fixed figure. Changes reflect your risk profile, claim severity, and prior history. Market context from Which? offers current insight to help you plan at renewal.

Report immediately, provide complete evidence, answer questions quickly, and keep records. Engage with the loss adjuster and consider a loss assessor for bigger claims or complex claims. Ask about interim payments once liability is confirmed and works begin.

.jpg)