What is Home Emergency Cover?

Home emergency cover gets a trusted tradesperson to you fast when something urgent makes your home unsafe or unusable. It can be an add on, included on higher tier policies, or bought as a standalone plan. It pays the call out, labour, and parts up to a limit for things like burst pipes, boiler breakdowns, or power cuts, covering the immediate fix rather than routine servicing or long term repairs.

Sources: Financial Ombudsman Service, MoneyHelper, Citizens Advice. Reviewed October 2025.

What is home emergency cover?

It is a service contract that arranges and pays for rapid help when a sudden problem risks damage or makes the home unliveable, for example no heating in winter, uncontrollable water leaks, total power failure, broken external doors or being locked out.

You contact a 24 hour helpline, the provider appoints an approved engineer, and the policy funds the call out, labour, and parts up to a per claim and annual limit, usually with an excess and sometimes a cap on visits.

It is different from buildings or contents insurance, which pays to repair the underlying damage after the event. Emergency cover focuses on making the property safe and usable again, not routine upkeep.

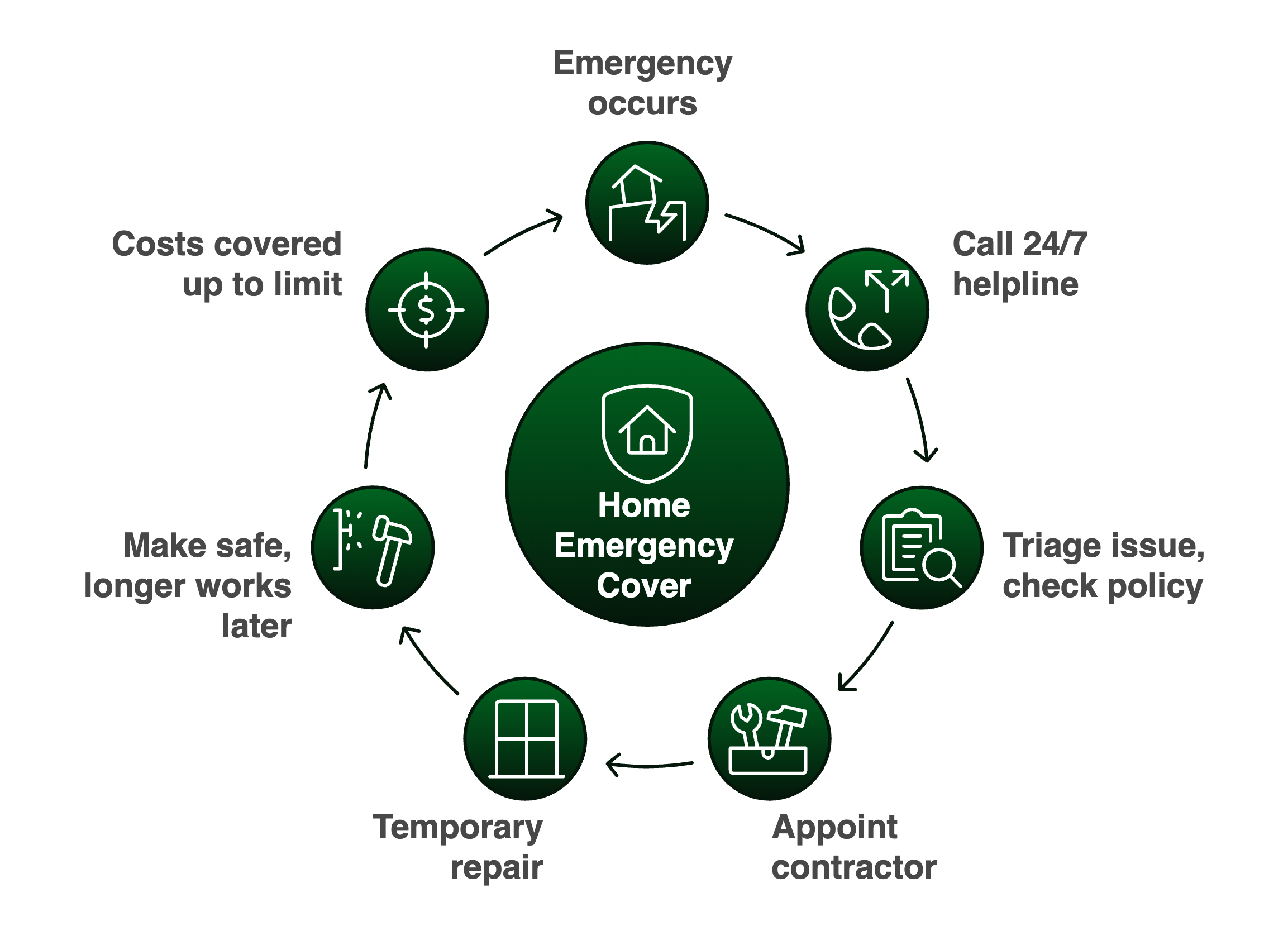

How home emergency cover works

You call a 24/7 helpline when an emergency happens. The insurer triages the issue against the home emergency policy, then appoints a local contractor to attend. Response times can lengthen in bad weather, so keep your schedule and policy wording handy to speed triage.

The contractor makes a temporary repair or, if similar in cost, a permanent repair that gets the home safe and usable. Think of this as urgent repairs that prevent further damage and remove any immediate security risk. For example, a broken window is boarded or internal electrical faults are made safe.

The policy will cover costs for call out charges, labour, parts and materials up to the limit. Any wider loss, such as damaged flooring after a water leak, usually sits with buildings or contents insurance. Financial Ombudsman casework reflects this split between emergency attendance and reinstatement.

Worked example

A burst pipes incident on a Sunday night. At 9.10pm you find water pouring from waste pipes and no hot water. You ring the emergency number, are triaged, and a plumber is sent with a 90 minute estimate.

By 11.15pm they isolate the main heating system, replace a split section of water pipes, and restore hot water. The emergency policy paid the call out, two hours of labour, and parts within the claim limit. Warped laminate was a buildings claim handled later.

What is usually covered

Cover focuses on total failure of essential services or urgent situations that leave the home unsafe. Typical inclusions are boiler breakdown, faults in the central heating system, burst pipes, internal drainage, electrical failure, broken locks or windows, blocked drains, roof damage that exposes the interior, lost keys, and pest infestations in living areas.

Policies may also respond to blocked sinks, unsafe gas pipes after the network has isolated supply, and a power cut traced to an internal fault. Some policies contribute to overnight accommodation where the home is temporarily uninhabitable. Always check the claim limit and any caps on parts or labour in your schedule.

What is usually not covered

General exclusions commonly include wear and tear, pre existing faults, routine maintenance, cosmetic only repairs, and long term works beyond the temporary repair. Appliances that are not part of the main heating system are often excluded, as are outbuildings for many perils. Some policies have a first 48 hours waiting period, and certain allowances have separate waiting periods.

Unoccupied properties frequently face restrictions. Many policies reduce or exclude cover after around 30 consecutive days, and some apply a seven day wait after re occupation. Check your wording and schedule to see how unoccupancy interacts with a home emergency claim.

Home emergency insurance vs standard home insurance

A practical rule helps. Emergency cover pays to stop the emergency now, keep the home safe, and restore essential services. Standard home insurance pays to cover damage and loss after the incident, such as redecorating or replacing damaged items.

Scope varies by provider. Check your schedule for limits, waiting periods, and exclusions.

Do you need it?

Owners and landlords may prefer predictable costs and rapid access to a local tradesperson rather than ringing around. If you travel or have a larger property, a total failure of hot water or central heating can escalate, so some choose extra protection.

Renters should check the tenancy agreement before they buy home emergency cover. For most assured shorthold tenancies the landlord must maintain the central heating system, electricity supply, and structure, so tenants may not need home emergency cover unless the agreement shifts locks or similar items.

If you prefer one point of contact, you can add home emergency cover at renewal, or arrange home emergency cover separately where the provider allows. If you keep a trusted trades list and savings, you might self fund emergency repairs instead.

What it costs and the limits to watch

A single emergency visit can exceed a year’s premium, especially for urgent electrics or a broken down boiler. If you would otherwise pay extra at short notice, emergency home insurance can smooth cash flow and cover costs for call outs, labour, and parts up to the claim limit.

Check whether policies cover older boilers and any requirement for proof of servicing. Some wordings only consider a replacement boiler if an economical repair is not possible. Many policies fund a temporary repair first, with any longer reinstatement handled by buildings or contents cover.

How to choose, a simple checklist

Use this checklist and cross check the small print:

rivr cover, how we approach emergencies

rivr covers high value homes and contents under one combined policy. Home Emergency is included as standard, you call us 24/7. We send a vetted tradesperson for urgent issues like no heating, serious leaks, internal electrics, locks or glazing, pests, or roof damage exposing the interior.

Costs are covered up to your schedule limit, with any excess and waiting periods set out in your home insurance policy documents.

Speak to our team today and experience digital-first insurance tailored to your lifestyle.

Read more

Frequently asked questions

Urgent call outs and repairs when essentials fail, for example heating, plumbing, electrics, locks, glazing, drains, and pests. Most insurers offer a similar core list on comprehensive policies, but check your policy documents for exact limits.

An event that makes the home unsafe, risks health, or risks permanent damage if not fixed quickly. Typical triggers are total loss of heat or hot water, serious leaks, internal electrical failure, or an immediate security risk.

It can be, especially if you want fast access to contractors and predictable costs, often sold as an optional extra. If you hold savings and trust your trades list, you may choose to self fund.

Prices vary by provider, property and limits, often cheaper as an add on than a standalone. Compare claim limits, number of call outs, waiting periods, and any call out fees.

Often yes, some policies set a separate excess for emergency claims. The amount and when it applies are shown in your policy documents.

Most policies attend a total failure of the main heating system, but boiler cover for servicing or gradual faults is not included. Check service history requirements and exclusions in your policy documents.

A slow dripping tap is usually classed as maintenance and is not covered. Sudden leaks that risk damage, for example a burst pipe, are more likely to be included.

Included when Section 4 Home Emergency appears on your schedule. You get a 24 to 7 helpline and a vetted tradesperson for urgent issues like no heating or hot water, serious leaks, internal electrics, locks or glazing that cannot secure, drains, pests, or roof damage exposing the interior.

We cover call out, parts and labour up to the limit shown on your schedule; any excess, waiting period, and what passes to buildings or contents apply as stated in your documents.

.jpg)